The markets began last week with a sharp pullback that pushed the broader Indices toward key support, with many individual stocks breaking below support. The drop occurred amid renewed banking fears after Tuesday, when San Francisco-based First Republic Bank (FRC) reported a slump of more than $100 billion in deposits in the first quarter.

Technology stocks were hardest hit, with Software and Semiconductor stocks down 3% Tuesday as investors sold shares in the face of FRC’s instability. Heavy selling on negative news such as last week will shake out weaker hands, but it can often pave the way for a sustained rally afterward — if market conditions are ripe, that is.

The major Indices were in fact able to find support, led by gains in mega-cap stocks such as Microsoft (MSFT) and Meta Platforms (META), who reported better than expected earnings. Stocks in other areas also drove the markets higher on Thursday and Friday after posting strong quarterly results, while also guiding growth higher for the year.

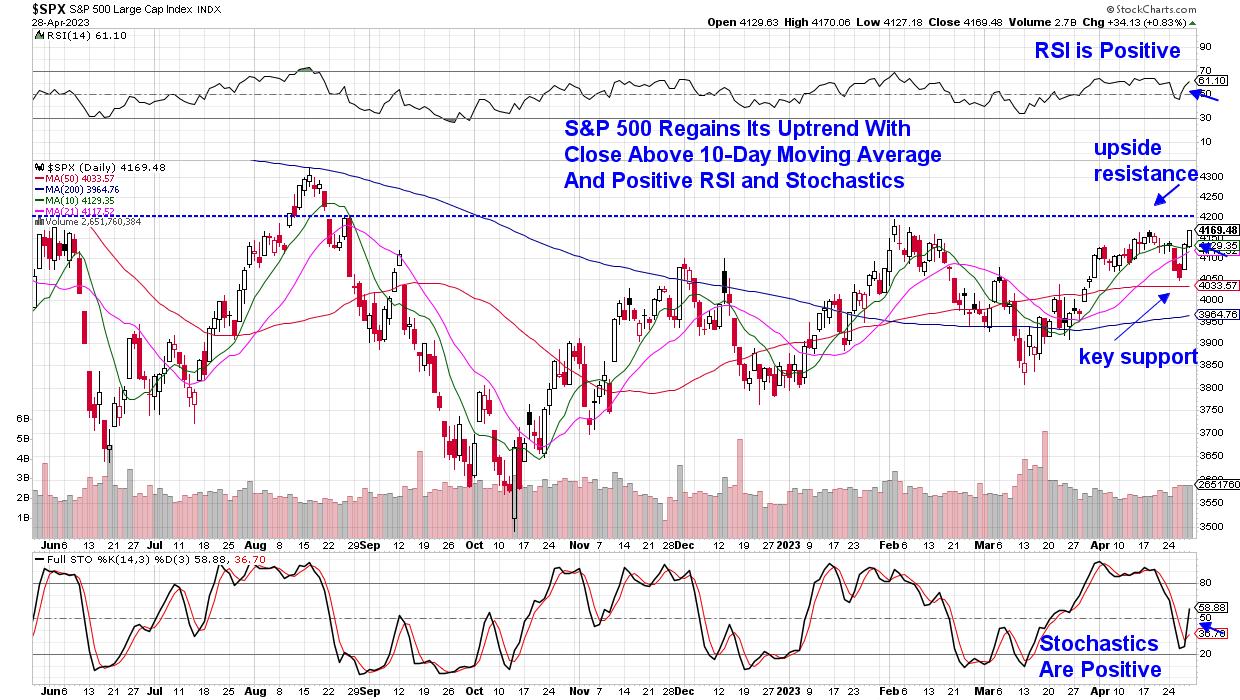

DAILY CHART OF S&P 500 INDEX

The broad-based rally later in the week not only pushed the S&P 500 back into an uptrend, but it helped improve breadth enough to inject some fuel into the markets. Next week will provide some major hurdles, however, as we head into Wednesday’s FOMC meeting and Powell’s post-meeting speech.

At this time, traders are anticipating a ¼% hike in the Fed Funds rate while also on the lookout for news that the hike will be its last one. Recent inflation reports, such as today’s core Personal Consumption Expenditure (PCE) data — a closely watched report for the Federal Reserve — showed that inflation is drifting lower, but overall, it remains quite sticky.

As highlighted in the S&P 500 chart above, 1200 is the next area of resistance and, should we move above this level on volume, the current rally may last longer. In addition to next week’s interest rate decision, Apple (AAPL) is due to report earnings on Thursday after the markets close, as will 800 other companies as we head into one of the busiest weeks of earnings season.

If you’d like to be alerted to any shift in my outlook for the broader markets, use this link here to take a 4-week trial of my twice weekly MEM Edge Report for a nominal fee. We stayed with the high quality stocks on our report’s Suggested Holdings List last week, despite cracks in some of the charts. These stocks are now poised to trade much higher, and you’ll receive immediate access to this list as well as in-depth sector and industry group analysis.

Warmly,

Mary Ellen McGonagle MEM Investment Research