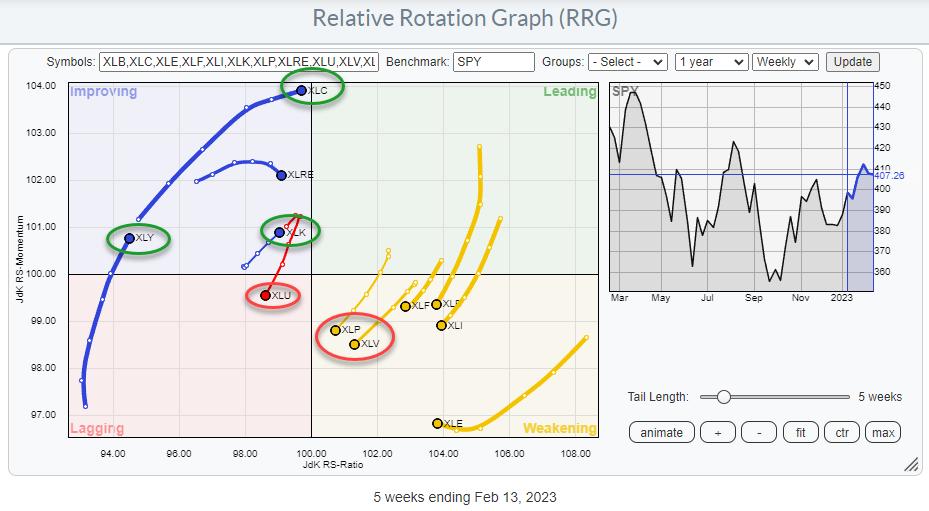

The Relative Rotation Graph for US sectors continues to show a shift out of defensive sectors into more offensive and economically sensitive ones.

The improvement for XLC (communication services, XLY (consumer discretionary), and XLK (technology) continues and is visible inside the improving quadrant. All three tails are travelling at a positive RRG-Heading. XLC and XLK are coming very close to crossing over into the leading quadrant, while XLY is still the sector with the lowest RS-Ratio reading but rapidly picking up now.

Communication Services

XLC managed to break away from its falling trend channel at the end of last year. Since then, a double bottom formation was completed, out of which a rally followed that brought the sector back to resistance near 60. The decline that followed after setting a peak against that resistance level is the first serious pull-back after breaking away from the bottoming formation.

On the back of that improvement in price, the relative strength for XLC against SPY has rapidly improved, and the tail on the RRG is now close to crossing over into the leading quadrant. Overall, the current setback seems to offer a good new entry point, especially when the tail on the daily RRG will rotate back into a positive RRG-Heading. Confirmation will be given when XLC can take out resistance at 60.

Technology

After breaking above its falling resistance and out of the declining channel, XLK is managing to hold up well above its previous high, now acting as support. This confirms that a new series of higher highs and higher lows is now in place.

Relative strength against SPY has just broken above its previous high, signalling an end to the relative downtrend as well.

On the RRG, the tail for XLK is inside improving, travelling at a strong RRG-Heading and ready to cross over into the leading quadrant.

Even if XLK dropped back below support between roughly 135-137, it would not immediately harmn the new trend. There is still a bit of room to manoever.

Here also, a rotation back to a positive RRG-Heading on the daily RRG tail will be the confirmation for further relative improvement over SPY.

Consumer Discretionary

The break above the falling resistance line marked the end of the downtrend that started at the end of 2021. For the last three weeks, XLY remained above its breakout level around 147, where falling trendline resistance co-incided with the horizontal resistance offered by the most recent peaks in H2-2022. This in itself is a sign of strength.

Combine this with a further improvement in relative strength and the weekly tail moving further into the improving quadrant, and things are looking good for XLY. The only things that makes XLY a bit more risky than XLK and XLC is the fact that it has the lowest Jdk RS-Ratio reading on the weekly RRG. This means there is still some risk for this tail to roll over while inside improving and not making it all the way to leading.

Just like for XLC and XLK, here also a rotation back up on the daily RRG will provide support for a further improvement in coming weeks.

Rotation out of Defense

On the opposite side of these rotations, at a positive RRG-Heading we are still seeing money flowing out of the defensive sectors. Their tails continue to travel at a negative RRG-Heading. XLU has already crossed into the lagging quadrant. XLV and XLP are still inside weakening but rapidly moving towards lagging.

Utilities

This sector has been showing a very choppy chart since it came down off its high near 78. In that move, trendline support was broken, as well as support coming from two previous lows. The rally then tried to break back above resistance, sending some confusing messages in the process. But finally that attempt failed, and a small double top formation was completed in that resistance zone, and the market is now working its way lower from that high.

Relative strength has started to move inline and recently broke below its former low, signalling that a downtrend is now in place. This puts the tail on the weekly RRG back into the lagging quadrant while at a negative RRG-Heading, suggesting that there is more relative weakness ahead in coming weeeks.

Consumer Staples

XLP dropped out of its rising channel in the first half of 2022. Since then, a trading range has developed between 66 and 77. The last rally to this upper boundary ended in another test of resistance and a failure to break. Out of this recent high a new series of lower highs and lower lows is developing, and XLP seems to be underway to the lower end of the range again.

This sideways price performance has also caused relative weakness for this sector, resulting in the tail on the weekly RRG to move rapidly towards the lagging quadrant, currently inside weakening, at a negative RRG-Heading.

Health Care

The third and final defensive sector is Health care. This sector already started trading in a range late 2021, starting 2022. The upper boundary is marked around 140 while the lower boundary is coming in around 122.50 with two to three dips towards 117.5.

This sideways movement caused really strong relative strength during 2022, when the S&P 500 moved significantly lower. However, XLV has not been able to keep up with the recent strength in the S&P, and relative strength is now rolling over. On the weekly RRG the XLV tail is following XLP towards the lagging quadrant.

All-in-All, rotation out of defensive sectors continues, and a more pronounced move into more offensive and sensitive sectors is starting to shape up. This suggests underlying strength for the broader market.

#StayAlert, –Julius