Before we get started today, I want to encourage you to subscribe to our new YouTube Channel for DecisionPoint. We post the recording of our weekly trading room there, and it is also full of educational videos that Erin has done over the years. Click on this LINK to subscribe now.

As part of the DP Diamonds subscription, on Fridays I give subscribers a “Sector to Watch” and an “Industry Group to Watch” for the following week. This week, it was somewhat difficult because I had a few sectors that looked interesting going into next week. It came down to Industrials (XLI) and Consumer Discretionary (XLY). Both charts look constructive, but I opted to go with Industrials this week.

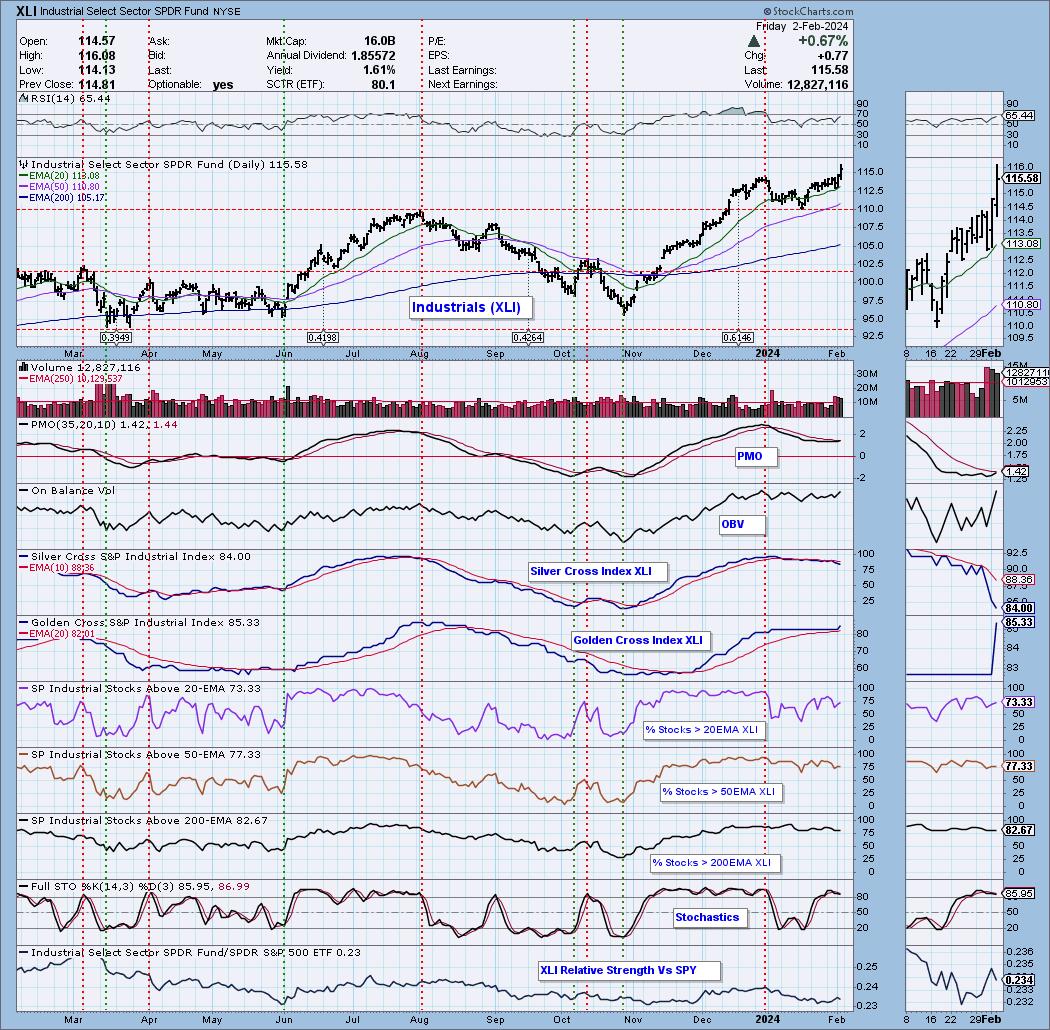

Sector to Watch: Industrials (XLI)

We recommend keeping a close eye on the Industrials (XLI) sector. Today saw a fantastic breakout above the 2023 high. The indicators are lined up well, and looking at “under the hood” participation suggests there is more upside to follow for the Industrials.

The only part of the chart that isn’t that positive is the Silver Cross Index, which is still in decline and could continue to decline based upon the fact that we have fewer stocks holding above their 20/50-day EMAs compared to the number of Silver Crosses within the sector. Remember, a Silver Cross is a 20-day EMA above the 50-day EMA; whereas a Golden Cross is a 50-day EMA above the 200-day EMA. The Silver Cross Index tells us how many stocks have a Silver Cross within the sector. The Golden Cross Index tells us how many stocks hold a Golden Cross.

Additionally, we have a positive RSI and nearing PMO Crossover BUY Signal well above the zero line. Participation is strong as far as %Stocks > 20/50/200-EMAs, and all of those indicators could accommodate more upside. The Golden Cross Index is angling higher and is above its signal line, giving us a Bullish LT Bias. We even see relative strength beginning to rise against the SPY.

Industry Group to Watch: Building Materials ($DJUSBD)

I noticed while reviewing the Industry Groups within the Industrials sector that most are lined up to do well or are already doing well. I selected Building Materials primarily for the breakout, but the nearing PMO Crossover BUY Signal helped too. The RSI is positive and not overbought on this breakout move. Stochastics are almost back above 80 and look strong. Relative strength is also picking up for the group as a whole. A few symbols to consider from this area: BLDR, KNF and VMC.

Good Luck & Good Trading,

Erin

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)