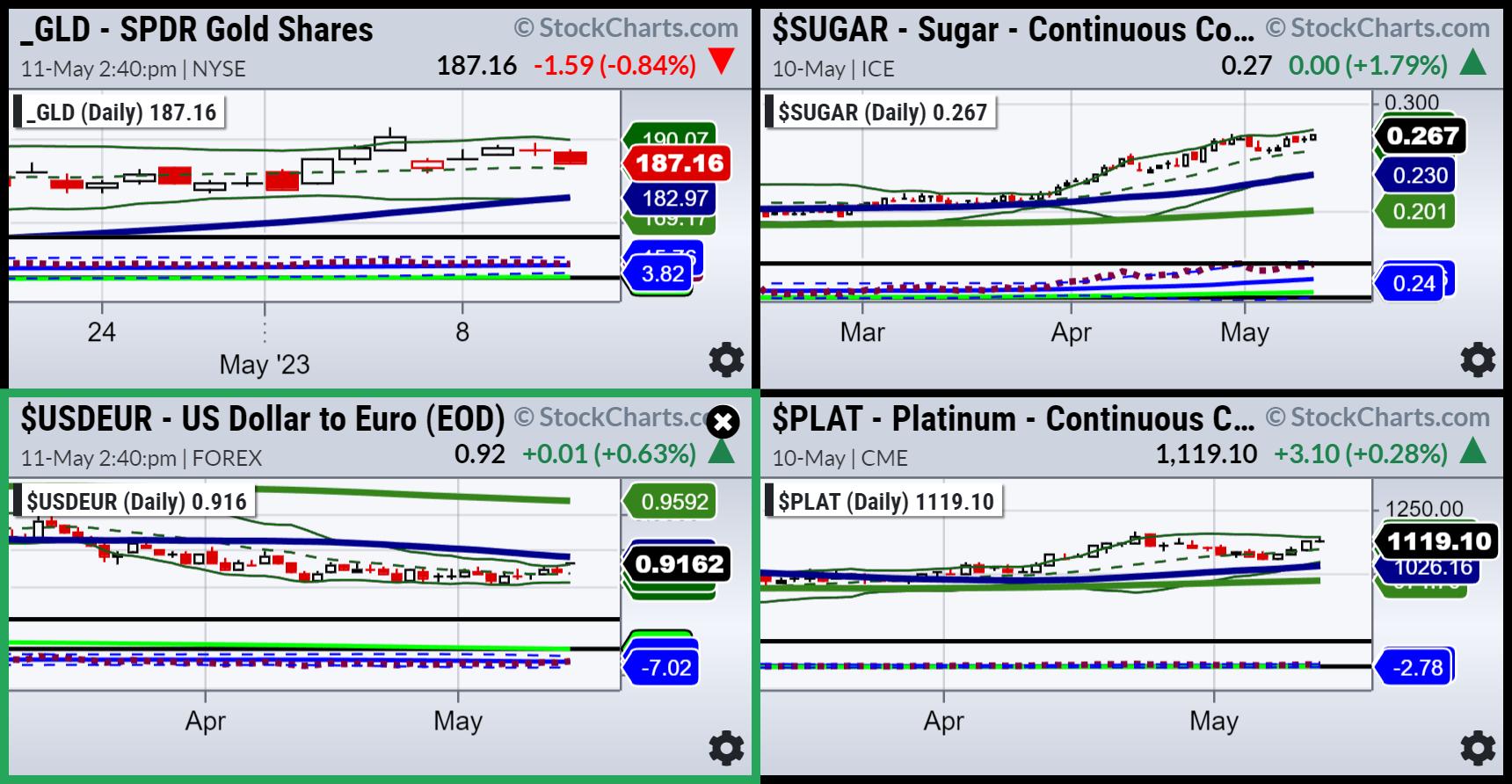

Today, I am including a clip that covers currency pairs and several commodities.

The four-chart screen is a daily screenshot of gold (GLD), sugar (continuous contract), the US dollar to the Euro (USDEUR) and platinum continuous contract (PLAT). Gold is falling from its recent highs. Sugar has run into some resistance ,with momentum currently in mean reversion to the downside. The Dollar to the Euro shows the dollar strengthening while its momentum has a bullish divergence. Platinum, mirroring gold, also looks like some resistance is at hand.

Have a listen to the clip as I go through the chart (futures) and give actionable information.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish walks you through the fundamentals and technical analysis legitimizing a meme stock on Business First AM.

In this appearance on Fox Business’s Making Money with Charles Payne, Mish and Charles discuss if economy has contracted enough with support in place, and present 3 stock picks.

Mish covers the trading range and a few of her recent stock picks on Business First AM.

In this appearance on Real Vision, Maggie Lake and Mish discuss current state of the market, from small caps to tech to gold.

In the Q2 edition of StockCharts TV’s Charting Forward 2023, hosted by David Keller, Mish joins RRG Research’s Julius de Kempenaer and Simpler Trading’s TG Watkins for an roundtable discussion about the things they are seeing in, and hearing about, the markets.

Mish and Dave Keller discuss why Mish believes that yields will peak in May, what to expect next in gold, and more in this in-studio appearance on StockCharts TV’s The Final Bar!

Mish explains why Grandma Retail (XRT) may become our new leading indicator on the May 4th edition of Your Daily Five.

Mish discusses the FOMC and which stock she’s buying, and when on Business First AM.

Mish covers strategy for SPY, QQQ, and IWM.

Coming Up:

May 18th: Presentation for Orios VC Fund, India

May 19th: Real Vision Analysis

May 22nd: TD Ameritrade

May 31st: Singapore Radio with Kai Ting 6:05pm ET MoneyFM 89.3.

ETF Summary

S&P 500 (SPY): 23-month MA 420.Russell 2000 (IWM): 170 support, 180 resistance.Dow (DIA): Now below the 23-month MA.Nasdaq (QQQ): 329 the 23-month MA.Regional Banks (KRE): 42 now pivotal resistance–holding last Thursday’s low.Semiconductors (SMH): 23-month MA at 124.Transportation (IYT): 202-240 biggest range to watch.Biotechnology (IBB): 121-135 range to watch from monthly charts.Retail (XRT): 56-75 trading range to break one way or another.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education