SPX Monitoring Purposes: Long SPX on 2/6/23 at 4110.98.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

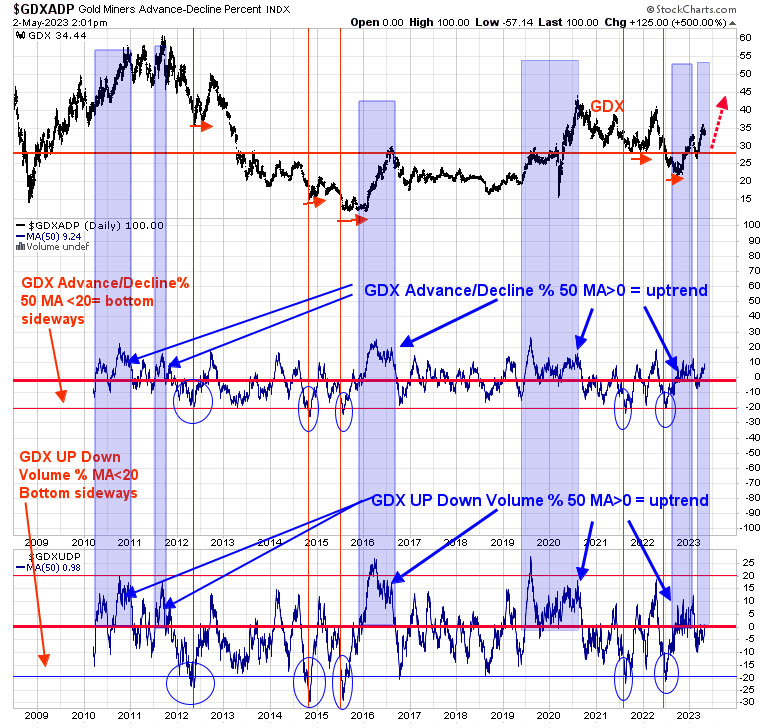

Yesterday, we said, “The bottom window is the 50-day average of the Up-Down Volume percent for GDX, and the next window higher is the 50-day average of the Advance/Decline percent for GDX. We found that the 50-day average of the Up Down Volume percent identify up rend in GDX when this indicator is above 0 and stays above 0. We noted these times with the light blue-shaded area. It helps to confirm the uptrend when the 50-day average of the Up Down Volume percent is also above 0, but the 50-day average of the Advance/Decline appears to carry the load better. Both indicators closed above 0 back in late August of last year, and the 50-day average of the Advance/Decline has held above 0 in general since that time and remains above it, currently suggesting the GDX rally has further to go.” Added to above is that 50-day average of Up Down Volume Percent (bottom window) closed above 0 today at +.98, suggesting the short-term consolidation may be ending and an impulse wave up is beginning.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.