Earnings season is close to ending, as over 80% of companies in the S&P 500 have reported their 4th quarter results already. The largest percent gainers among stocks over the past four weeks have been those that reported strong earnings or where management guided growth estimates higher going forward. With this all in mind, savvy investors should be putting a watch list together to take advantage of the potential outperformance among companies that have yet to report.

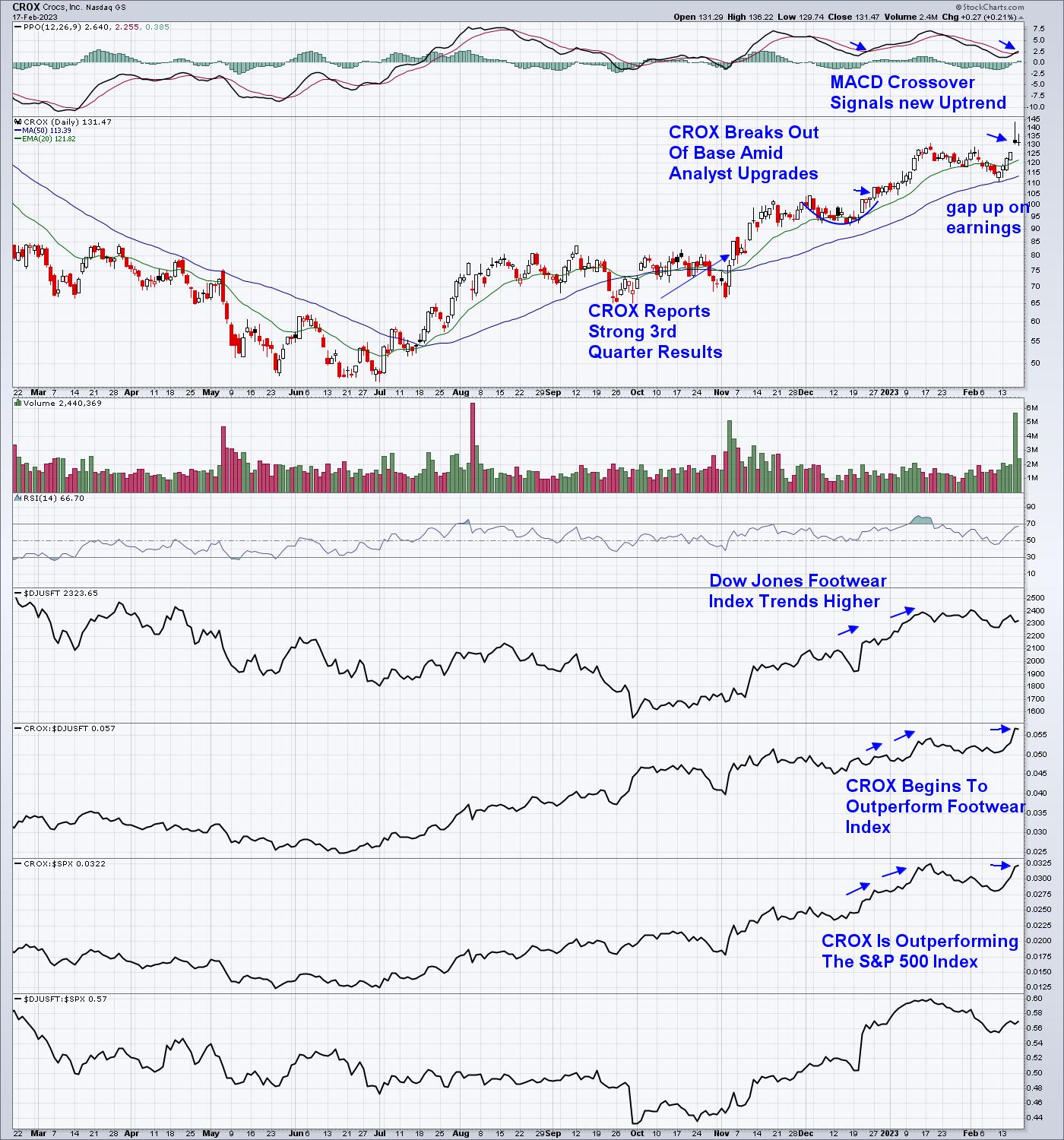

An example of one such outperformer is Crocs (CROX), which gained 14% last week after a rally into earnings that was capped by a 4.5% gap up after reporting results that were above estimates. Subscribers to my MEM Edge Report were alerted to CROX last December after it broke out of a 3-week base amid analyst upgrades.

DAILY CHART OF CROCS INC. (CROX)

Analyst upgrades going into earnings is one item to watch out for as you put together your watchlist. This is because Wall Street researchers often have access to more detailed information relative to individual investors, and they’re unlikely to put their neck on the line with an upgrade that’s not well researched. You can stay on top of upgrades and downgrades to estimates with services such as MarketWatch.

Tuning into the strength of a stock’s industry group is another way to uncover candidates for your watch list. You’ll want your company to be in an area where other stocks are trending higher as well, as, most likely, there’s growth taking place across the industry. This industry group strength can easily be uncovered using StockCharts.com’s SCTR rating under the Sector Summary sub Industry Group list.

In addition, your best watchlist candidates will be top performers within their group, as their winning ways will often continue after they report positive results. Again, the SCTR rating of stocks within an industry group is an ideal way to uncover the relative outperformers with the best-looking charts.

From here, you’ll want to pay attention to the stocks earnings releases from the past as, statistically, a company that has a history of reporting results above estimates will continue to do so. This was true of CROX, shown above.

DAILY CHART OF S&P RETAIL ETF (XRT)

Over the next several weeks, many retailers will be revealing their quarterly earnings and sales results, as they are the last area to report. The good news is Retail Sales surged in January, which will improve the possibility of a positive outlook for growth going forward. A close look at Wednesday’s Retail Sales shows that food service led all major categories after increasing by 7.2%.

Next week, one of the eleven stocks on the Suggested Holdings List of my MEM Edge Report is due to report their earnings. Not only is it in the Restaurant group, where the largest surge in retail sales occurred, but it is the top relative performer amid analyst upgrades. You can get immediate access to this stock by using this link here. You’ll also receive 4 weeks of this highly-regarded, twice-weekly report delivered directly to your email going forward.

While not mentioned above, the status of the broader markets is one of the most important aspects to determine if you should get involved with a stock. The MEM Edge Report provides a detailed outlook of the markets as well. I hope you’ll join the many pleased subscribers to this report so that you, too, can invest successfully and with confidence.

Warmly,

Mary Ellen McGonagle, MEM Investment Research