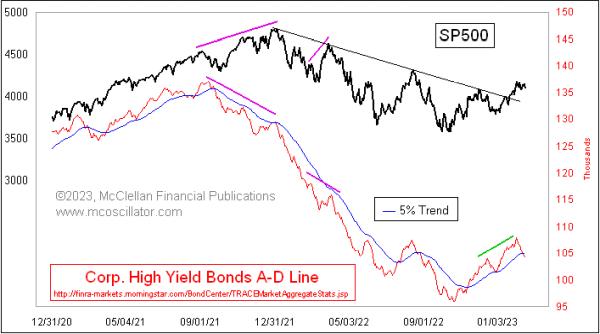

Early in 2023, the S&P 500 broke out above the year-long downtrend line that everyone has been watching, and it has been struggling a little bit in February 2023 trying to extend that breakout. While it looks like just a pause for the S&P 500, the underlying weakness is evident when we look elsewhere, especially among the investments which are the most vulnerable to liquidity problems, the high-yield corporate bonds.

HY bonds trade more like the stock market than like Treasury bonds, because HY bonds are subject to the same vicissitudes of financial market liquidity waxing and waning. FINRA publishes the data on advances and declines every day here, and it can give useful insights for the stock market. One can even make the case that the HY Bond A-D Line serves as a better canary in the coal mine than the composite NYSE A-D Line.

This A-D Line started showing us a big bearish divergence in late 2021, even ahead of the pretty big divergence in the NYSE’s A-D Line. That bearish divergence correctly foretold the awful market weakness we endured in 2022.

There is no bearish divergence showing now, but we are seeing a suddenly weak HY Bond A-D Line. It peaked on Feb. 2, 2023, the same day as the S&P 500, but, since then, it has been falling almost daily and has now dropped below its 5% Trend. Having it below that exponential moving average (EMA) is what happens during price downtrends.

The message is that financial market liquidity has suddenly left the building, and that this is going to come around and bite even the big-cap stocks. They can muscle aside the little guys for a while, like the big pigs at the feeding trough, but eventually it affects them too. The vulnerable ones are more useful in this respect, showing us that the liquidity is drying up ahead of time.