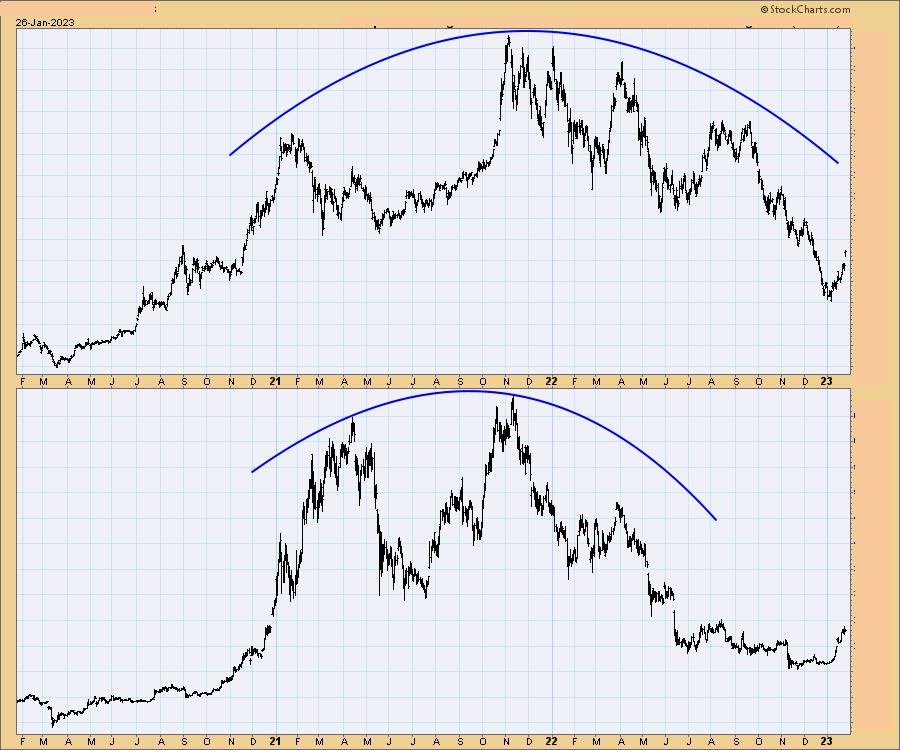

Last month in our DecisionPoint Trading Room I gave our viewers a pop quiz. I presented two similar charts without names or price scales, and challenged them to identify them by the shape of the price indexes alone. The point I was trying to make was that, while they were different, they were driven by similar waves of psychology. They began at a 2020 low, moved to a 2021 high, formed great rounded tops, then crashed in 2022.

The point I was making was that the psychology behind each was virtually identical — buyers in a buying panic driving prices to irrational levels, then selling when the fantasy faded. Let’s see who they are and how similar their journeys were.

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

The top chart panel is Tesla (TSLA), an electric car company, and the bottom panel is Bitcoin ($BTCUSD), a crypto currency. They are essentially different investment products, but they have moved with amazing similarity. Frankly, I didn’t know how amazing until I started writing this article and began refining the annotations. Both launched from a March 2020 bottom, advanced about +1750% into a November 2021 top, then crashed about -75% into 2022 bottoms. They are now both rallying off those bottoms, and amazingly, they have both rallied about +60%.

We have to wonder what would drive such an amazing advance. In my opinion, it comes from magical, Tulip Bulb, bubble thinking. For Tesla, the underlying belief seemed to be that everyone was going to own an electric vehicle, and it was going to be a Tesla.

For Bitcoin, the belief was that the sky was the limit for an “asset” that has no intrinsic value. It was grand for a while, but there was never anything there except fantasy, and the truth that a Bitcoin has no claim on anything finally won out. It is only worth what someone is willing to pay for it. As an aside, there was also belief that a crypto investment was an investment in Blockchain technology. While the investments were maintained within a Blockchain system, there was never any direct ownership of that technology.

Conclusion: These are unrelated investment products, yet they moved with astounding similarity. I will assert that there is no fundamental basis for this, other than the human tendency to lose track of reality from time to time, and to follow emotions to unreasonable lengths.

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.