This past week, I got to talk a lot about inflation, something many have thrown in the towel about. But not us!

In particular, I sat down with Charles Payne during his show Making Money with Charles Payne on Fox Business. He prepared a list of questions for me.

Charles: You say inflation has cooled but its only taking a break and not over — what reignites it?

According to the research I did for How to Grow Your Wealth in 2023, I developed a list of TEN potential sparkplugs.

China demand increasingThe U.S. dollar under siege, with BRICS the biggest threatGeopolitical risks, like an increase in coup d’étatsMassive government spending both here and abroadRecord debt ceiling with the potential to see a money printing resolutionAn oil shortage or crisisFood shortages and hoardingSocial Unrest leading to supply chain bottlenecksCentral Banks losing control of monetary policy-chaosRussia/Ukraine War worsening

First off, by nature, commodities are volatile. Furthermore, Super Cycles do not last 1-2 years — typically, they last 3-4 years. So, if 2021 was the start, then 2024 to even 2025 is when it could cycle away.

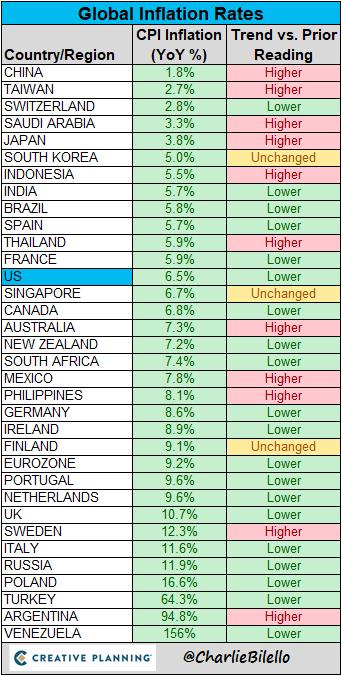

Statistically, inflation rates over 6% (we have had it at 9%, and all it has done is cool to over 6%) take at least 6 years to fix. That’s if we are really committed to fixing it. Seems the Fed is wishy-washy, and sovereigns everywhere are trying to spend their way out of a recession–also inflationary.

As far as actionable information, we think Gold doubles over time. The weekly chart shows a clean breakout above the moving averages. Our Real Motion indicator reveals even with the rally, momentum has not caught up. We would love a correction to add to the position. However, the circle on the chart shows you a gap that had not been filled going back to mid-April 2022. That gap has now been filled. We consider that a positive. Plus, the Triple Play Leadership indicator has GLD well outperforming the SPY

Gold is our main focus, but that also takes other commodities along for the ride–particularly miners.

Finally, looking at the rise in gas prices, we assume that that is inflationary in and of itself. Moreover, we also see higher oil prices as long as crude oil holds around $80 a barrel.

Charles: I like this line from your note: “But one thing we know – it’s more important to adapt to changing landscape then get stuck on a macro theme.” How does that apply to investing?

One must be flexible and open-minded, especially those of us who are active and not passive investors.

Best case scenario is that these headwinds abate and companies, plus consumers, adjust to higher rates topping at 5%. That could lead to the “soft landing” while the market finds footing and a decent trading range.

Worst case scenario is that volatility and inflation continue to move higher, The Fed has more fat to trim, yet are still unable to stop the price of gold and other hard assets from moving up.

祝你兔年幸福安康! – May your year of the Rabbit be full of happiness and health!

Mish’s Picks are already up 10-20% outperforming the SPY!

Want to take advantage of her stellar track record and ensure a profitable trading year? For more detailed trading information, contact Rob Quinn, our Chief Strategy Consultant, to learn more about Mish’s Premium trading service.

You don’t want to miss Mish’s 2023 Market Outlook, E-available now!

Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish maps out why gold is still the shiniest in this appearance on Making Money with Charles Payne!

In Singapore, Mish discusses China and whether the markets are bottoming or going lower from here on CNBC Asia.

In StockCharts TV’s Charting Forward 2023, Mish sits down with a round table panel of experts for an open discussion about the things they are seeing in, and hearing about, the markets.

Mish presents her 2023 Outlook and gives you 6 trading ideas from Macro to Micro on the Thursday, January 12 edition of StockCharts TV’s Your Daily Five.

Mish and John discuss how equities and commodities can rally together, up to a point, in this appearance on Bloomberg BNN.

Mish and the team discuss her outlook and why inflation will persist, with a focus on gold, in this appearance on Benzinga.

While the weekly charts still say bear market rally, Mish and and host Dave Keller discuss the promise of the daily charts on the Tuesday, January 10 edition of The Final Bar (full video here).

In this appearance on Business First AM, Mish discusses the worldwide inflation worries.

ETF Summary

S&P 500 (SPY): The January calendar range reset this week; SPY fails the 200 and is now slightly below the 200-DMA again; it closed crossing above the 50-DMA, but very narrow price range to 200-DMA. Held pivotal support at 390, and 200-DMA is resistance.Russell 2000 (IWM): In better shape than SPY, but still a nasty reversal and must continue holding 180. Filled the gap and first level of resistance 182, and overhead resistance at 187.Dow (DIA): Back under the 50-DMA still as industrials lose ground. Needs to continue to hold pivotal support at 330. Nasdaq (QQQ): Crossed the 50-DMA on Friday to close above. First level of tight support. Support 277 and resistance 283.Regional Banks (KRE): Led the way down and now must continue to hold 57.50. Currently close to crossing 60.72 (50-DMA). First level of support is 58 and resistance is 50-DMA.Semiconductors (SMH): Still holding key support easily at the 50-WMA and 200-WMA. 221 support and 228 resistance.Transportation (IYT): Still holding 225 key support here and now holding first level of support 227. Biotechnology (IBB): Still best sector, with 132 key support still holding and holding first level of support at 134, now with 137 resistance.Retail (XRT): Holding pivotal support at 63. Resistance at 66.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education