There are tons of charts to choose from to make a point about how bullish or bearish the market is. However, when you pick broad market charts, there is little to argue a point. Composite exchange charts (all the stocks in a group) reach a broad swath of the economy and help you see a wider view, rather than a narrower selection of the Nasdaq 100 ($NDX), the S&P 500 index ($SPX), the Dow Jones Industrial Average ($INDU), or a specific industry.

NYSE Line Chart

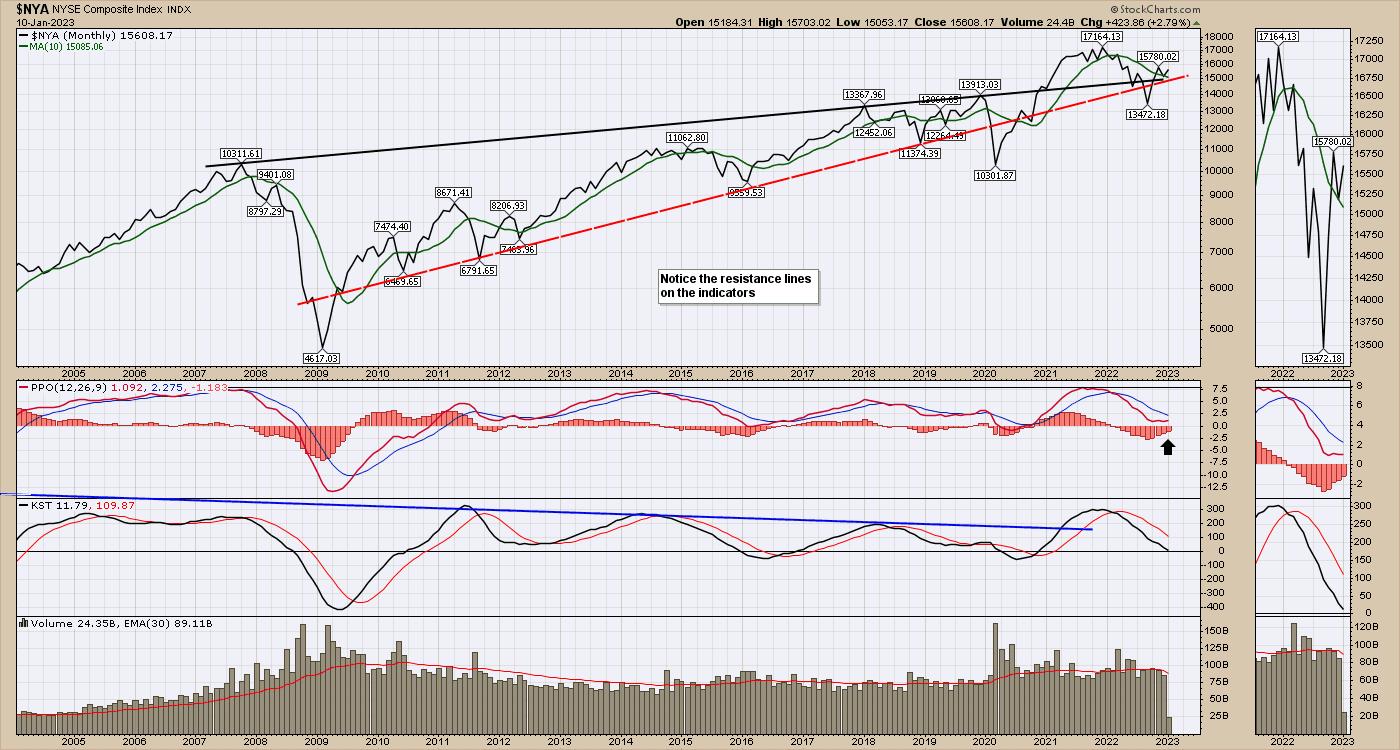

The charts below are from the NYSE. The NYSE Composite index ($NYA) represents the ‘stock exchange’ rather than a select group of the best charts.

This week, $NYA sits at an important crossroads, one it hasn’t visited in a long time. The junction of the top trend line since the 2007 high, the support trend line since 2010, and the 10-month moving average (MA) are all providing support under this chart after the 2020 frenzy of free government money. The chart exploded higher in 2020 through 2021 and slipped lower for most of 2022. $NYA bottomed in October 2022.

The percent price oscillator (PPO) is trying to turn up, just above zero. If the oscillator turns higher from here, it could be bullish. You don’t want to see the PPO start to fail and drop below zero.

Another interesting clue is that in the 2008–2009 crisis, volume accelerated above the average until the market lows of October 2008 were in. The current volume seems comfortable below the MA, hinting that large investors may not be too worried if the market doesn’t get through this threshold level.

NYSE Bar Chart

When you look at the monthly bar chart rather than a line chart, a few other clues come into play. A bar chart shows the price throughout the month, not just the closing price.

Price sits at the monthly trend line. So far, there have been four months of higher lows. $NYA also seems to be holding above its 10-month MA, which was a resistance level in mid-2022. The PPO is the same as the chart above, and indicates that this is a typical bounce point. The difference is that this bounce is taking place without the Fed’s help.

NYSE Weekly Bar Chart

Moving to the weekly chart (see chart below) and a few more interesting things pop up.

The chart is holding above the 10-week MA (blue line). This was a support level all the way through 2020 and most of 2021. It’s also trending up and has clearly broken any downtrend drawn on the MA. Price on a weekly chart looks much better and has broken a down trend line on the previous highs and has bounced off that line. The PPO is turning up very bullishly, right at zero.

As $NYA continues to rally, this looks more and more like the start of a bull market. I have a variety of charts telling me to be more positive on the outlook. It seems each week in the newsletter to clients, the stock market’s bullish outlook is improving.

I also did a presentation about how we expect to manage the market turbulence in 2023 as we have a couple of interesting crossroads coming at us. That presentation can be found here. Investing Strategies From Osprey Strategic.

Grab a beverage and see if some of the ideas presented can help you preserve capital while enjoying the upside. Have a wonderful 2023!